The financial landscape is evolving rapidly, with technology playing a pivotal role in reshaping how services are delivered. One of the most groundbreaking innovations in recent years is embedded finance insurance. This emerging trend integrates insurance products seamlessly into non-financial digital platforms, offering users a streamlined, convenient, and highly personalized experience.

This article will explore the concept of embedded finance insurance, its workings, key benefits, use cases, challenges, and future prospects. By the end, you will have a thorough understanding of how embedded insurance is revolutionizing financial services.

What Is Embedded Finance Insurance?

Embedded finance insurance refers to the seamless integration of insurance services within non-financial platforms. Rather than purchasing insurance separately, consumers can access coverage directly through apps and services they already use, such as e-commerce platforms, ride-sharing apps, or fintech solutions.

Key Characteristics of Embedded Finance Insurance

- Seamless Integration: Insurance is embedded directly within a product or service, eliminating the need for separate transactions.

- Personalization: Offers tailored insurance policies based on user behavior and data.

- Automation: AI and machine learning facilitate automated underwriting and claims processing.

- Accessibility: Makes insurance more accessible by reaching consumers through digital touchpoints they frequently use.

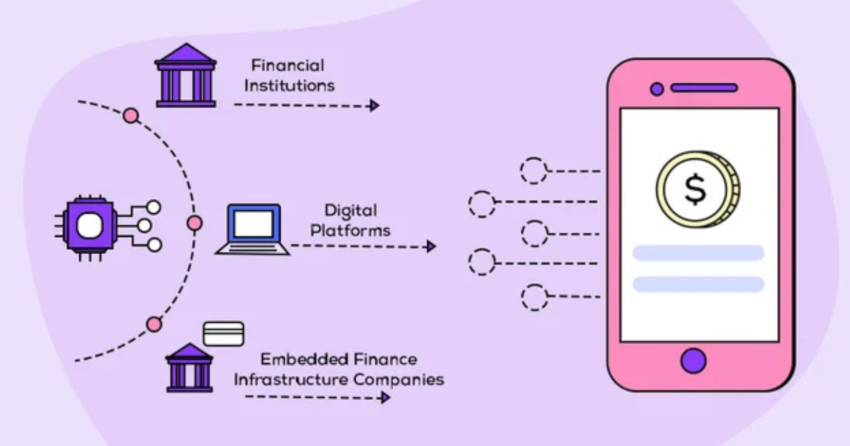

How Does Embedded Finance Insurance Work?

1. Integration with Digital Platforms

Embedded insurance operates through APIs (Application Programming Interfaces) that connect insurance providers with digital platforms. These integrations allow businesses to offer insurance coverage as an add-on feature during the user journey.

2. Data-Driven Customization

By leveraging AI and big data analytics, embedded insurance providers can offer highly customized policies. For example, an e-commerce platform can provide return shipping insurance based on a user’s purchase history.

3. Automated Underwriting and Claims Processing

Automated underwriting ensures that policies are approved instantly based on predefined algorithms. Similarly, claims processing is streamlined with AI-powered evaluations, reducing human intervention and expediting payouts.

4. Embedded Pricing Models

Pricing is integrated within the service or product cost, making it more palatable for consumers. This method enhances adoption rates, as customers perceive it as an extension of their purchase rather than an additional financial burden.

Benefits of Embedded Finance Insurance

1. Enhanced Customer Experience

Consumers no longer need to navigate through complex insurance policies and third-party providers. Everything is accessible in a single, user-friendly interface.

2. Increased Business Revenue

Businesses integrating insurance can generate additional revenue streams without the need for building standalone insurance services.

3. Higher Conversion Rates

Because embedded insurance is seamlessly integrated into the purchasing process, it leads to higher conversion rates compared to traditional standalone insurance models.

4. Real-Time Coverage Activation

Users can obtain instant coverage while purchasing a product or service, ensuring they are protected immediately.

5. Reduced Operational Costs

Automation in underwriting and claims processing reduces administrative costs and increases efficiency for insurers and businesses alike.

Use Cases of Embedded Finance Insurance

1. E-Commerce Platforms

Retailers and marketplaces embed insurance for product returns, damage protection, and extended warranties at the point of sale.

2. Ride-Sharing and Mobility Services

Companies like Uber and Lyft provide embedded insurance for drivers and passengers to ensure coverage during trips.

3. Travel Industry

Airlines and travel agencies offer embedded travel insurance to cover trip cancellations, lost baggage, and medical emergencies.

4. Fintech and Digital Banks

Neobanks and fintech platforms integrate insurance options, such as cyber protection, income protection, or overdraft coverage, into their banking services.

5. Healthcare and Telemedicine

Embedded insurance in healthcare platforms ensures that patients have immediate access to medical coverage when booking appointments or purchasing prescriptions online.

Challenges and Risks of Embedded Finance Insurance

1. Regulatory Compliance

Insurance regulations vary across jurisdictions, requiring businesses to navigate complex legal frameworks to ensure compliance.

2. Data Privacy and Security

Since embedded insurance relies heavily on user data, ensuring robust cybersecurity and adherence to data protection laws is essential.

3. Consumer Awareness and Trust

Some consumers may be skeptical about purchasing insurance from non-traditional providers, requiring businesses to build trust through transparency and education.

4. Integration Complexity

Seamless API integration between insurers and digital platforms requires significant technical expertise and investment.

5. Claims Management Efficiency

While automation speeds up claims processing, there may still be challenges in handling disputed or complex claims fairly.

Future of Embedded Finance Insurance

The embedded insurance market is poised for significant growth, with advancements in AI, blockchain, and IoT driving further innovation. Some emerging trends include:

- AI-Driven Personalization: More sophisticated AI models will enhance policy customization and risk assessment.

- Blockchain for Smart Contracts: Blockchain technology can improve transparency and efficiency in policy management and claims processing.

- Expansion into New Industries: Beyond fintech and e-commerce, industries like real estate and education are expected to adopt embedded insurance solutions.

- Regulatory Evolution: As embedded insurance grows, regulators will establish clearer guidelines to ensure consumer protection and fair practices.

Also Read: What Is Crypto Asset Insurance And Why Is It Important?

Conclusion

Embedded finance insurance is revolutionizing the way insurance is delivered, making it more accessible, convenient, and tailored to individual needs. By integrating insurance into digital platforms, businesses can enhance customer experience, drive additional revenue, and improve adoption rates. However, challenges like regulatory compliance, data security, and integration complexity must be addressed for sustainable growth.

As technology continues to evolve, embedded insurance will likely become a standard offering across various industries, transforming the traditional insurance landscape. Businesses that leverage this innovation effectively will gain a competitive edge in an increasingly digital world.

FAQs

1. What is embedded finance insurance?

Embedded finance insurance refers to the integration of insurance services into non-financial digital platforms, allowing users to access coverage within existing services.

2. How does embedded insurance differ from traditional insurance?

Traditional insurance requires consumers to purchase policies separately, whereas embedded insurance is seamlessly included in a product or service.

3. Which industries benefit from embedded insurance?

Industries such as e-commerce, fintech, mobility services, travel, and healthcare benefit significantly from embedded insurance solutions.

4. What are the risks of embedded insurance?

Key risks include regulatory challenges, data security concerns, and potential consumer skepticism.

5. What is the future of embedded finance insurance?

The future of embedded insurance will see greater adoption driven by AI, blockchain, and expanding use cases across diverse industries.